What is Freetrade?

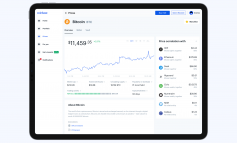

Freetrade is a cell phone application based venture stage for exchanging shares, trade exchanged assets and speculation trusts. It offers without commission exchanging, with no exchange expenses, and no stage charges for an overall speculation account. Freetrade is situated in the UK and its application was dispatched in October 2018. Discover more: read our manual for the best and most exceedingly speculation stages. New user that sign up through this link will receive a FREE SHARE WORTH UP TO £200.

Is Freetrade acceptable?

Despite the fact that we couldn’t overview enough of Freetrade’s clients to make client scores, potential clients should observe various focuses. Freetrade’s ‘sans bonus’ model could save you a lot of cash contrasted with other DIY speculation stages. Be that as it may, the scope of ventures it offers is more limited than different stages, with just US and UK stocks, just as ETFs and trusts. It offers a restricted determination of venture news, yet less instruments than you’ll discover at other DIY stages. New user that sign up through this link will receive a FREE SHARE WORTH UP TO £200.

What are Freetrade’s charges?

Yearly charges General venture accounts are free £3/month (£36 every year) for stocks and offers Isa £9.99/month (£119.88 per year) for self-contributed benefits plan (Sipp – £7 if a Freetrade Plus part) £9.99/month (£119.88 per year) for Freetrade Plus Trading charges No charge for purchasing and selling resources 0.45% cash change overcharge No charge for moving in or out.New user that sign up through this link will receive a FREE SHARE WORTH UP TO £200.

Who is Freetrade useful for?

The shortfall of exchange or stage expenses makes Freetrade a decent choice on the off chance that you can reproduce your present portfolio with it. It might likewise suit the people who oftentimes exchange shares – however remember the determination of offers is undeniably more restricted, and the devices are more fundamental. You likewise can’t cast a ballot in organization AGMs. Discover more: putting straightforwardly in shares

Who is Freetrade costly for?

Freetrade’s £3/month Isa charge implies that, for arrangement of £10,000 or less, you’d be in an ideal situation with DIY stages like Vanguard, Charles Stanley Direct, Fidelity, Close Brothers Asset Management or HSBC. Given the restricted determination of ventures presented by Freetrade, think about your speculation objectives, and regardless of whether changing to save money on exchange and stage expenses merits undermining your system. You’ll likewise should be open to dealing with your venture by cell phone application. Discover more: look at venture stage charges

What records and administrations does Freetrade offer?

The data underneath gives an at-look perspective on the key things that the records and administrations Freetrade offers.

Components set apart with a

✓ are presented by Freetrade and those set apart with a ✘ are not.

✓ General venture account An overall speculation account that can hold various kinds of speculations however doesn’t give tax-exempt advantages like benefits and Isas.

✓ Sipps A Sipp is an annuity where you have full oversight over the speculations you put your investment funds into.

✓ Stocks and offers Isa A stocks and offers Isa is a tax-exempt record that permits you to place your cash in a scope of ventures. ! Bank account With Freetrade Plus (costing £9.99 every month) you can make 3% premium on money up to a most extreme store of £4,000.

✘ Advisory administrations Advisory administrations permit you to get to proficient venture guidance.

✘ Lifetime Isa A lifetime Isa is a tax-exempt reserve funds or venture account intended to assist with peopling matured 18-39 purchase their first home or save for retirement.

✘ Annuity An annuity is a protection item which permits you to trade your benefits investment funds for a dependable standard pay that will keep going for the remainder of your life.

✘ Banking administrations Banking administrations permit you to work ledgers, make moves and make installments. ✘ Income drawdown Income drawdown permits you to remove cash from your benefits to live on in retirement. Discover more: how speculation stages work New user that sign up through this link will receive a FREE SHARE WORTH UP TO £200.

Is your cash protected with Freetrade?

On the off chance that Freetrade left business, you would be repaid by the Financial Services Compensation Scheme (FSCS). The FSCS will conceal to £85,000 of speculations per individual, per stage. You can guarantee for nothing on the web: there’s not a remotely good excuse to utilize a cases the executives organization. You will not be made up for speculations falling in esteem, or an organization where you hold shares becomes bankrupt, except if this horrible showing came about because of terrible guidance given by a directed Independent Financial Advisor that has since gone belly up.

Open a new account with Freetrade using our referral code to receive a FREE share worth between £3-£200.

Leave a Reply